By Akeem Lasisi

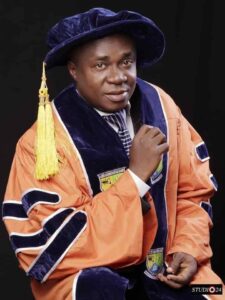

Professor of Capital Market, Uche Uwaleke, has advocated the establishment of the kind of ‘intellectual ecosystem’ exemplified by the American Silicon Valley to boost the Nigerian economy.

According to him, entrepreneurial knowledge ecosystem can be seen as the interconnected network of actors, institutions, and processes that collectively enable the creation of wealth.

Uwaleke made the recommendation last Wednesday when he delivered the 50th inaugural lecture of the Nasarawa State University, Keffi.

It was titled ‘Unlocking Wealth and Leveraging Entrepreneurial Knowledge Ecosystems: Understanding Capital Harnessing Essentials’.

With the title, Uwaleke had shown how creative he is as a scholar as its acronym is the same as his name: UWALEKE UCHE.

He told the eminent personalities who rallied round him at the programme that a thriving entrepreneurial ecosystem was characterised by a skilled workforce, access to medium-to-long term capital, and a stimulating environment that enables innovation.

Uwaleke noted, “A good example of an entrepreneurial knowledge ecosystem is the Silicon Valley, located in the southern part of San Francisco Bay Area in Northern California in the United States. It integrates universities like Stanford, tech companies, venture capital firms, research institutions, and entrepreneurial communities to create a globally recognized hub for innovation and entrepreneurship. The Silicon Valley is home to FAANG stocks: an acronym for the stocks of companies of US technology giants namely Facebook, Amazon, Apple, Netflix, and Google which trade on the NASDAQ. According to the world Bank, the GDP of the state of California was about US$3.9 trillion in 2023 making it the fifth largest economy in the world.

“In essence, the entrepreneurial knowledge ecosystem can be the backbone that unlocks wealth and fosters strong economic growth. Entrepreneurial knowledge is critical for understanding how to access, manage, and optimize resources. While educational Institutions represent a major stakeholder in this ecosystem, the government is expected to facilitate a conducive environment for developing entrepreneurial knowledge. The connection between entrepreneurial knowledge ecosystem and the capital market lies in how the latter serves as a crucial enabler for entrepreneurs and governments, offering the platforms and providing long-term resources needed for funding innovation and unlocking wealth.”

In the lecture, the don assessed the progress Nigeria’s economy has made in recent times, while also highlighting the challenges.

On some of the factors hindering fiscal growth, he said, “Like in most commodity-based economies, the prospects of wealth creation and shared prosperity are hampered by a number of factors among which is weak domestic output, owing in part to overreliance of the economy on crude oil. As a matter of fact, the Nigerian economy has gone through two cycles of recession since the dawn of the 21st century (2016/17 and 2022)- no thanks to oil price collapse and COVID-19.

“As disclosed in the National Integrated Infrastructure Master Plan, in order to narrow the huge infrastructure gap, Nigeria needs to invest US$3 trillion in infrastructure over a 30-year period -US$100bn annually in other words. This translates to a yearly investment of over N150 trillion! This is more than twice the size of the total annual budgets of the federal and Sub-National governments. No doubt, financing this huge infrastructure gap presents a formidable challenge to the government given Nigeria’s low revenue to GDP ratio of less than 10% making inevitable the mobilization of long-term private capital.

“Regrettably, over the years, there is evidence to suggest that money raised from the debt capital market for capital projects ended up being used to meet recurrent needs. This funding mismatch, characteristic of public spending in Nigeria, has worked against any effort to harness the country’s idle resources.

According to Uwaleke, a former Commissioner for Finance in Imo State, the country has, however, in the last 10 years, made remarkable progress in capital market development.

He stated, “The menu of available asset classes has been expanded to include Exchange Traded Funds and derivatives, market infrastructure has been modernised and strengthened with the Platforms such as NASD, FMDQ as well as Commodity exchanges firmly in place. I am also aware that the SEC is in the process of finding accommodation for digital assets within its regulatory purview enabled by the Investment and Securities Bill 2024 which was passed by the National Assembly last year.

“While these are encouraging developments, the country’s capital market continues to trail behind that of peer countries. The flagship securities exchange, the Nigerian Exchange, is small compared to the major international exchanges, with a total equities market capitalization of N56.5 trillion (about $35 billion,) as at end of September 2024, according to data from the NGX, housing only 151 companies. This pales in comparison to the Johannesburg Stock Exchange with 274 listed companies and equities capitalization of about US$1 trillion representing over 280 per cent of South Africa’s GDP. It goes without saying that at less than 15 per cent of the Nigeria’s GDP, the current size of the capital market constrains its role in national economic development.

“Also, the issuer base is not diversified with the NGX dominated by a few companies which leaves the market vulnerable to shocks. This is demonstrated by the fact that only 10 (out of 151 listed companies) account for over 60% of equities market capitalisation.”

The inugural lecture was graced by many eminent people who included Senator Tokunbo Abiru, Chairman Senate Committee on Banking Insurance & Other Financial Institutions; Dr Emomotimi Agama, Director General, Securities and Exchange Commission; Ms Patience Oniha, Director General, Debt Management Office; Tope Fasua, Special Adviser to President Tinubu on Economic Affairs; and Prof Haruna Ayuba, Vice Chancellor Bingham University.